For many individuals purchasing their first home, the down payment is likely the largest upfront expense. For many the down payment is simply too large and they cannot afford it. Recently it has become more popular for homebuyers to receive down payment gift funds to help with this large upfront expense.

In this post I will be explaining some of the rules surrounding gift funds as well as some of the myths surrounding taxes when it comes to gift funds.

How Do Down Payment Gift Funds Work

You can use gift funds in order to make the down payment on a home. In order to do this the lender will need to know some details before you’re allowed to use it. There are only two groups of people who are allowed to give a homebuyer gift funds.

Family or Friends – you must be able to prove a long standing relationship with a friend or family member to provide funds.

Government Organization – there are several first time homebuyer programs that allow individuals to enter the buyer market. Here in Colorado the primary down payment assistance program is CHFA.

Confirming The Relationship

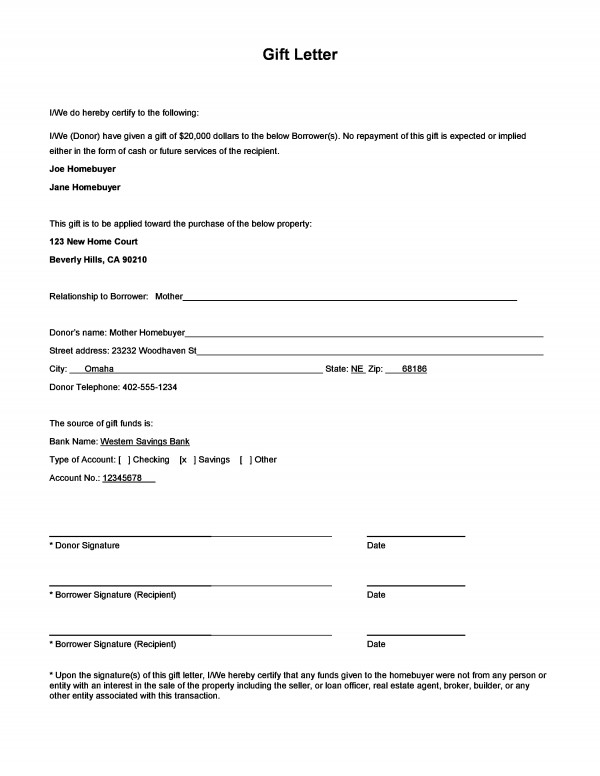

If you’re receiving the gift funds from a friend or family member you must verify the relationship between the two parties. This is usually done by providing a letter to the lender.

A lender may also require other verification of the gift. For example, they may ask to see the givers bank statements to verify they have the funds available to give as a gift. Many times the funds are transferred during the application process to give plenty of time for the funds to show up on bank statements for both you and the giver. This gives the lender ample time to verify the funds are from a legitimate source and verify your relationship.

Can Gift Funds Be Paid Back?

The answer to this is simply no. This is considered loan fraud. All loans are taken into consideration when determining a buyers debt-to-income ratio. If gift funds are loaned this would put the buyers qualifications at risk.

How Much Can Be Gifted For A Down Payment?

The individual limit on tax free gift funds is $15,000 per individual. This means parents could gift a total of $30,000 annually. If they gift more they would be subject to taxes on those additional funds.

In most cases there’s no limit to the amount of gift funds you can use for a down payment on a primary residence. However, if gift funds are being used for a second home or investment property you must pay at least 5% of the down payment.

Seasoned Money

If possible, it would be a good idea to have seasoned money in your account before it is used for a down payment – this avoids the gift documentation needed too. Lenders are looking for proof that funds have been in your account for a substantial amount of time instead of gathering a significant amount of money in a short period of time just before purchasing the home.

Seasoned funds should be in your account for at least two months before applying for a loan. If a parent gifts $15,000 three months before the buyer purchase home the lender is unlikely to ask about it. This is seasoned money.

The Gift Tax Myth: How To Navigate Around It

Many people aren’t aware of the fact that, in most situations, there really is no gift tax. Here’s why…

$15,000 Annual Exclusion

The federal government gives each of us an allowance to gift anybody $15,000 per year without incurring any gift tax. This $15,000/year replenishes every year, and it’s $15,000 per person. So, theoretically, I could gift every person that I know $15,000 today, and then another $15,000 next year and the year after, and there would be NO gift tax.

$11,580,000 Lifetime Exclusion

What most people don’t realize, is that there’s a second allowance of $11.58mm! In other words, let’s say that I want to give you $115,000. That’s $100,000 more than what I can give you out of my $15,000 annual bucket. That’s not a problem at all because I also have the $11,580,000 bucket. The $11.58mm bucket is called my “Lifetime Exclusion.” If I use any of it during my lifetime, I simply reduce my estate tax exclusion by that amount.

So in our example, if I gift you $115,000, I would take $15,000 out of my annual bucket and $100,000 out of my lifetime bucket. My annual bucket replenishes each year. But my lifetime bucket does NOT replenish. In fact, I must reduce my lifetime bucket by $100,000, so now my lifetime exclusion is “only” $11.48mm instead of $11.58mm.

Now, if my estate is less than $11.48mm, this would not be a problem at all, because my heirs would have no estate tax anyhow. However, if my estate is more than $11.48mm than my heirs would have to pay estate taxes on anything inherited above $11.48mm. In other words, the lifetime exclusion bucket is used for both gift and estate tax purposes. So every time I use it to not pay gift taxes, I’m also reducing my estate tax exclusion… that’s how and why the gift tax and the estate tax are related to one another.

$23,160,000 Lifetime Exclusion For Married Couples

One thing to keep in mind about the lifetime exclusion bucket is that the amount changes each year. In 2020, the exclusion is $11.58mm, but it is scheduled to go up in the years ahead because it is indexed to inflation. Also, keep in mind that I can “port” over my $11.58mm to my spouse if I’m married. So technically, a married couple could have a total joint exclusion of $23,160,000! Therefore, if you are married and your net worth is less than $23,160,000, there is absolutely no reason whatsoever for you to concern yourself with the gift tax. That’s because even if you gift your entire net worth during your lifetime, you would pay $0 in gift taxes and your heirs would pay $0 in estate taxes. That’s why the gift tax is really a non-issue for most people!

What Paperwork Is Required?

If you’re using the $15,000 annual bucket, the gift doesn’t need to be reported to the IRS if you follow the proper procedures. However, if you’re using the $11,580,000 lifetime bucket, you would need to file a gift tax return with the IRS (even though no gift tax would be due). This is done to simply notify the IRS that you’re using part of your gift/estate tax exclusion.

Also, make sure the checks are written by the specific individuals who are giving the gift. In other words, if mom is gifting you $15,000, and dad is also gifting you $15,000, you’ll need two separate checks: one from mom and one from dad.

Buying a Home is More Than a Down Payment

Ultimately, the cost of the down payment is only one expense to consider in the home-buying process. Homebuyers need to pay for closing costs, which include expenses like an appraisal, credit report, and underwriting fees.

Down payment gifts can make it easier for homebuyers to afford a home.

If you’re in the market for a new home and want a little help, don’t hesitate — just make sure you follow the above steps to ensure you accept such a gift in the proper manner. When you speak with your lender about what loan is best for you, make sure you let them know upfront that you plan on using gift funds for the down payment. Some loans have strict guidelines on how much gift money you can use for a down payment and who can gift you the money.

How Can I Help You With Your Real Estate Needs?

I am consistently among the Top Real estate agents in Broomfield and I strive to exceed client expectations.

I am consistently among the Top Real estate agents in Broomfield and I strive to exceed client expectations.

You May Be Wondering… What is My Home Worth?

Do you wonder what your home is worth in the current market? Do you desire a specific Property Valuation Report that I routinely prepare for my clients? Please contact me.

If you are considering buying or selling, I would appreciate the opportunity to earn your business (or that of a friend you think I could help).

Visit www.refrealty.net. Phone: 720.351.8488, or John@RefRealty.net

For questions regarding the Broomfield Real Estate Market in general contact:

John Grandt

Realtor® | Real Estate Negotiation Specialist

Global Luxury Property Specialist

John@RefRealty.net

720.351.8488